The cryptocurrency market witnessed a rollercoaster ride last week, with the global market cap collapsing to a two-month low of $1.76 trillion, as Bitcoin dropped below $50,000.

The global crypto market cap, however, recovered to the $2.15 trillion mark amid a rebound from Bitcoin (BTC) and other major altcoins.

Here are our top cryptocurrencies to watch this week following their notable performances last week:

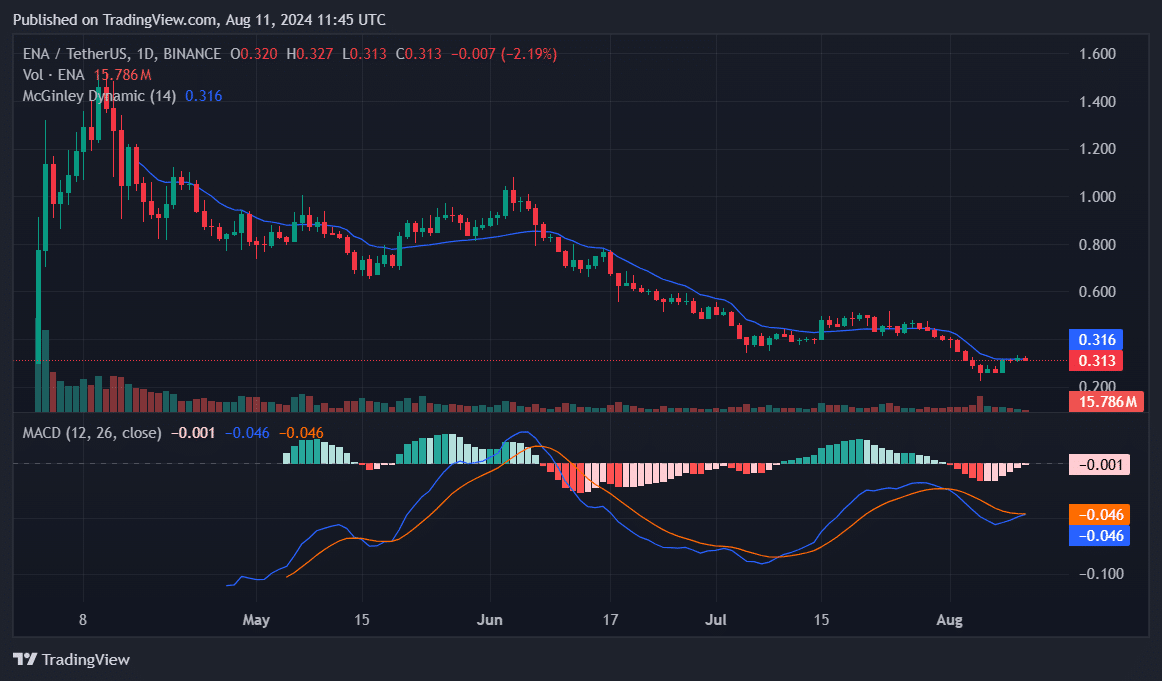

ENA survives onslaught

Ethena (ENA) slumped with the rest of the market on Aug. 5. It eventually recovered to close the week at $0.32, slightly above the McGinley Dynamic line at $0.316.

This marks a modest 2% weekly increase for ENA.

The MACD currently shows a bearish momentum. This suggests that selling pressure has been dominant, although the gap between the two lines is narrowing, indicating a potential shift in momentum.

The McGinley Dynamic is acting as a resistance level. The ENA price has struggled to break above it amid weak bullish sentiment. If Ethena fails to sustain above this level, it may retest the $0.30 support, with a potential downside towards $0.28.

However, if buying pressure increases and the price breaks above the McGinley Dynamic, a move toward $0.35 could be expected. The MACD crossover, if it occurs, could confirm this bullish reversal.

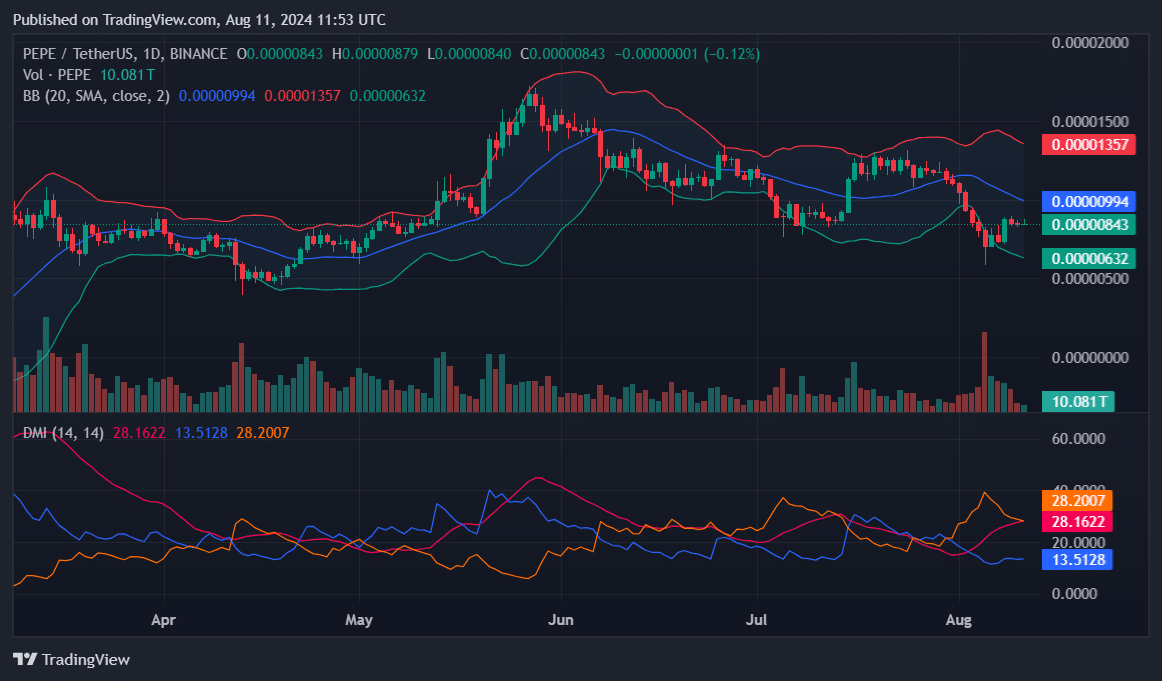

Pepe hovers around lower Bollinger Band

Pepe (PEPE) experienced notable volatility over the past week, dropping to a low of $0.00000585 on Aug. 5 before rebounding.

The meme coin’s price fluctuated significantly, ultimately closing the week at $0.00000844 — a 2% decline.

The Bollinger Bands show that PEPE traded close to the lower band, which suggests it was in an oversold region. The price dipped below the middle band, around $0.00000994, mid-week, signaling bearish momentum.

The Directional Movement Index shows mixed signals. The ADX, which measures trend strength, is at 28.2, indicating a moderately strong trend.

If Pepe fails to reclaim the middle Bollinger Band, it could continue trading near the lower band, potentially testing the $0.00000632 support. Conversely, if bullish momentum returns, breaking above $0.00000994 could pave the way for a recovery towards $0.00001357.

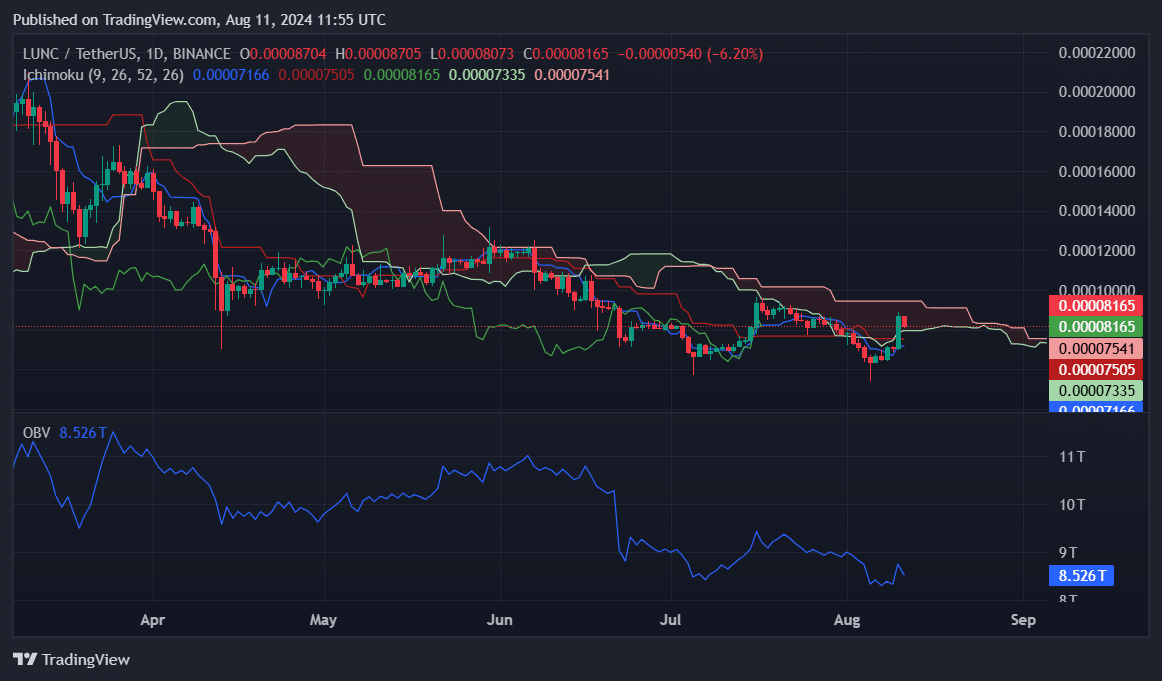

LUNC spikes 22%

Terra Classic (LUNC) experienced a strong bullish reversal last week, closing at $0.00008705 after a 22% spike.

The majority of this surge occurred on the last day of the week, with LUNC witnessing a remarkable 23% intraday gain.

The Ichimoku Cloud indicator suggests a potential trend reversal. LUNC closed above the Tenkan-sen, $0.00007505, and the Kijun-sen, $0.00007335, showing bullish momentum.

However, the price remains below the Kumo cloud, which spans $0.00007466 to $0.00008705, indicating resistance ahead.

To confirm a bullish trend, Terra Classic would need to break and close above the cloud, particularly surpassing the upper boundary.

Meanwhile, the On-Balance Volume is at 8.526 trillion, showing an increase in buying pressure. If LUNC manages to break above the Ichimoku Cloud, it could target higher resistance levels around $0.00010000. However, failure to sustain momentum might result in a retracement towards the Kijun-sen or even lower.