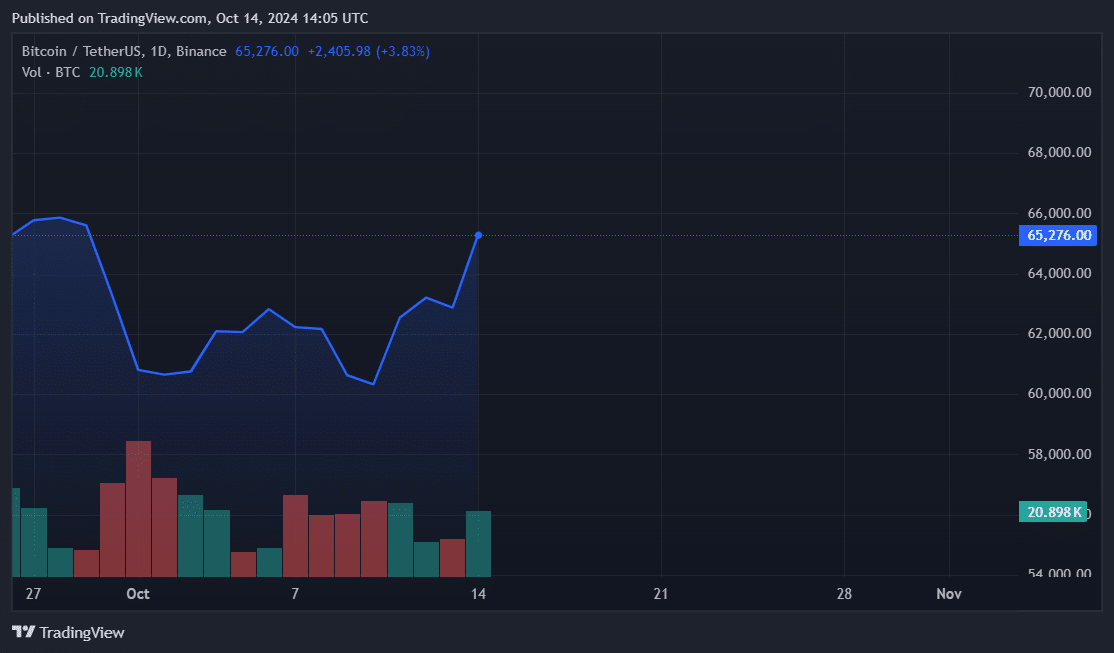

Bitcoin’s leap toward $65,000 after a lackluster start to October could catalyze gains historically experienced during this month, according to QCP Capital.

Analysts from the crypto trading firm said in its Telegram channel Bitcoin’s (BTC) 4% price jump on Oct. 14 might signal a rally for the leading cryptocurrency during the second half of the month. A total crypto market uptick liquidated nearly $80 million in BTC and Ethereum (ETH) leveraged short positions, easing the bearish overhang on these two market leaders and the broader digital asset space.

QCP experts also noted that BTC’s pump arrived three weeks before the November U.S. presidential elections. Trading data showed that BTC recorded similar price patterns on two previous occasions. Bitcoin doubled in value by January 2017, after starting its price ascent in October, just before the 2016 elections. Like this year, BTC had been range-bound for months ahead of regime change in America.

In 2020, less than a month before the presidential election, Bitcoin surged from around $11,000 to over $42,000 by Q1 2021, nearly tripling in value.

If history repeats itself, and Bitcoin’s bull market resurges following U.S. elections, BTC’s value could reach or exceed $120,000 by early 2025. A base case where BTC doubles in price would also push the token’s market cap well above $2 trillion, marking a significant milestone for the flagship cryptocurrency.

QCP Capital analysts added that Mt. Gox’s updated repayment plan might bolster BTC’s bullish outlook. Last week, the defunct BTC exchange postponed its creditor reimbursement deadline to October 2025. According to crypto.news, BTC buying activity has also stalled sell pressure across several digital asset exchanges.

Uptober has been rather disappointing so far with BTC up just +1.2% vs an average of +21%. After months of trading in the range, will history repeat itself? Today’s rally has definitely given the market a glimmer of hope just as Uptober optimism was fading.

QCP Capital