Bitcoin price has done modestly well this week as it soared to $66,000, rising to its highest level since July 31.

Bitcoin moves into bull market

Bitcoin (BTC) recovery coincided with the surge of the most risky assets like altcoins and equities. The Dow Jones and the S&P 500 index have jumped to a record high, while the Nasdaq 100 is a few points below its all-time high.

In a post on X.com, crypto analyst Miles Deutscher estimated that Bitcoin may continue rising in the near term, reaching a high of $81,000.

He argued that the S&P 500 index, which tracks the biggest American companies, was up by 9% above its highest level this year. As such, he told his 541,000 followers that the coin would hit $81,000 if it caught up with equities as it has done in the past.

Other analysts are bullish on Bitcoin. In a recent note, analysts at BlackRock, the biggest asset manager in the world, referred to Bitcoin as a “unique diversifier” in a report on Sept. 17.

The New York-based firm argued that the top cryptocurrency was a unique asset that is uncorrelated with equities, especially in periods of elevated risks.

BlackRock has continued allocating Bitcoin in its balance sheet, a move that may inspire other firms to start buying.

Meanwhile, MicroStrategy has continued to accumulate Bitcoin. The firm’s founder, Michael Saylor, predicts that Bitcoin will rise to over $13 million by 2045. The company currently holds over 252,000 coins.

MC Consultunacy founder and self-proclaimed Bitcoin enthusiast Michael van de Poppe also noted that the coin would jump to between $90,000 and $100,000 by the end of the year. He cited the soaring global liquidity, which will increase as central banks slash interest rates.

Seasonality is also favoring Bitcoin in the near term. CoinGlass data shows that the average return in the fourth quarter is 88%, higher than the third quarter’s 6.3% and the second quarter’s 27%.

October and November are usually the best months for the coin.

Polymarket traders are betting that the coin will jump to a new all-time high in 2024 — 63% odds.

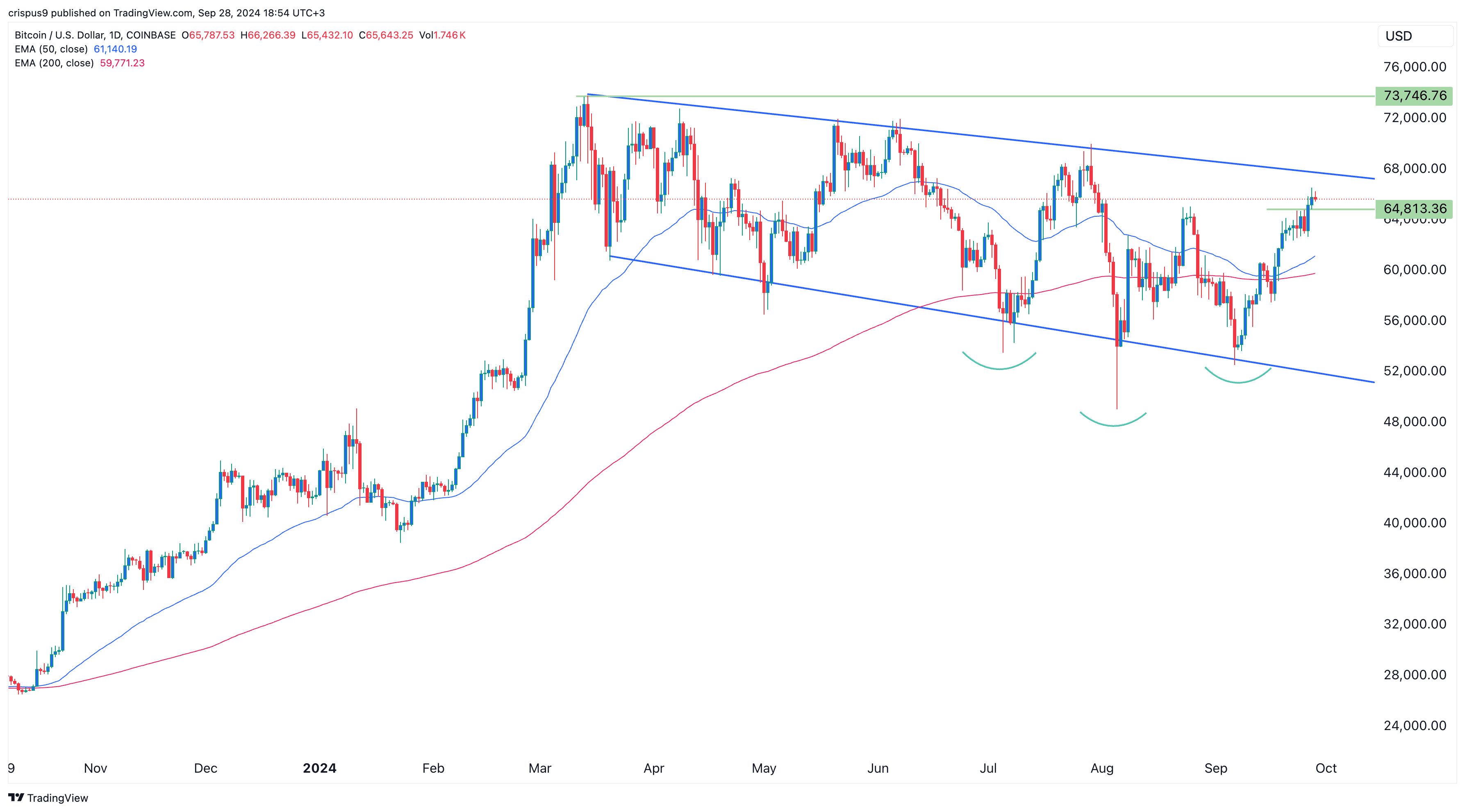

Bitcoin technicals

The daily chart shows that Bitcoin has solid technicals. It has formed an inverse head and shoulders pattern, a popular bullish sign. It has also been forming a falling broadening wedge.

Bitcoin has avoided forming a death cross pattern, and has instead, moved above the 50-day and 200-day moving averages. The coin will need to move above the upper side of the wedge to continue the bullish trend and clear the year-to-date high of 73,777 to accelerate the recovery.