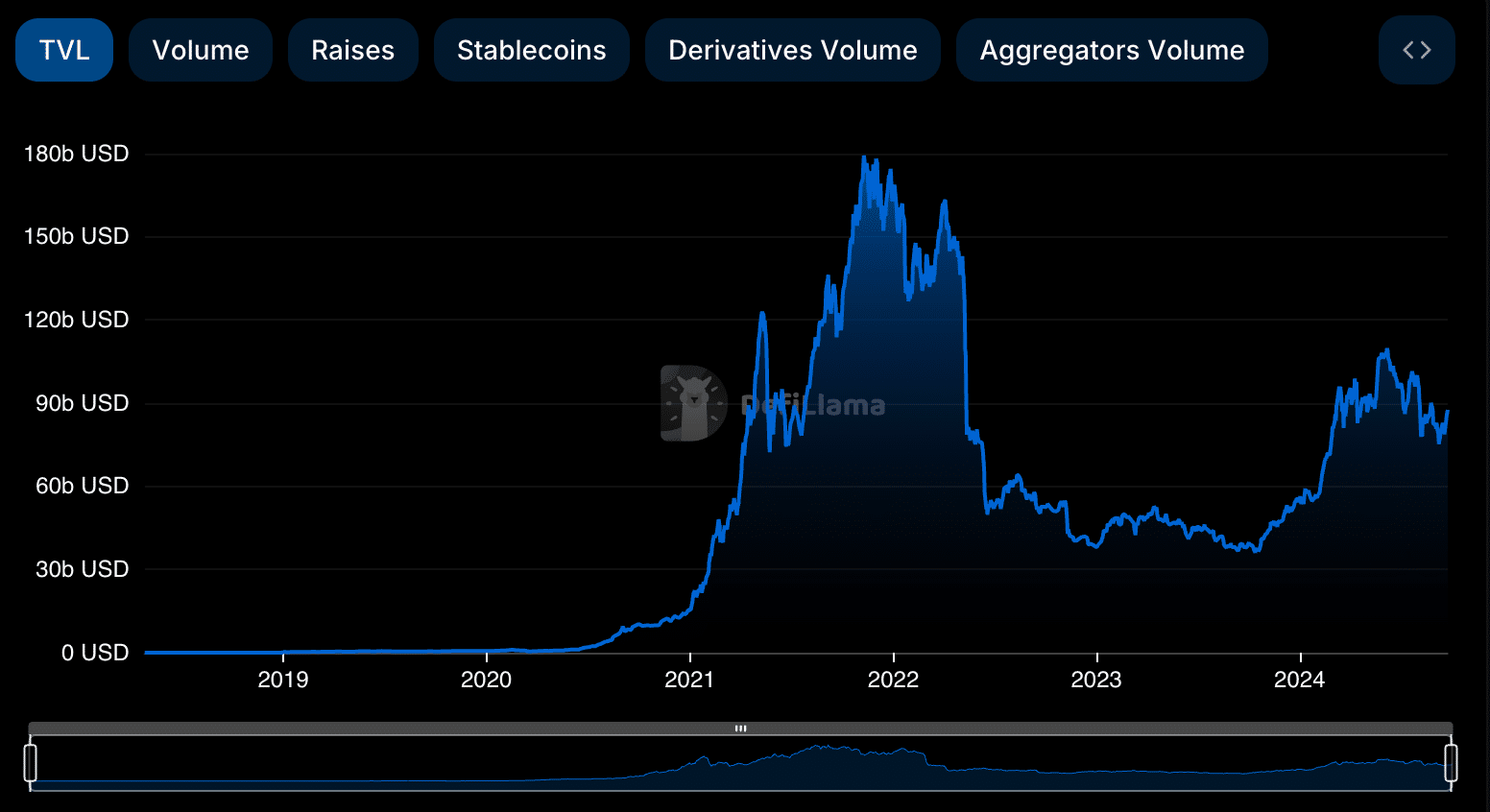

The total value locked in decentralized finance protocols has reached its one-month high as the broader crypto market recovers.

According to data provided by DefiLlama, the global DeFi TVL is currently sitting at $87.3 billion — a level last seen on Aug. 27. The weekly trading volume, however, declined by 2.2% in the last seven days and is hovering at $23 billion.

Notably, the DeFi TVL plunged to $75 billion on Sept. 7 for the first time since late February.

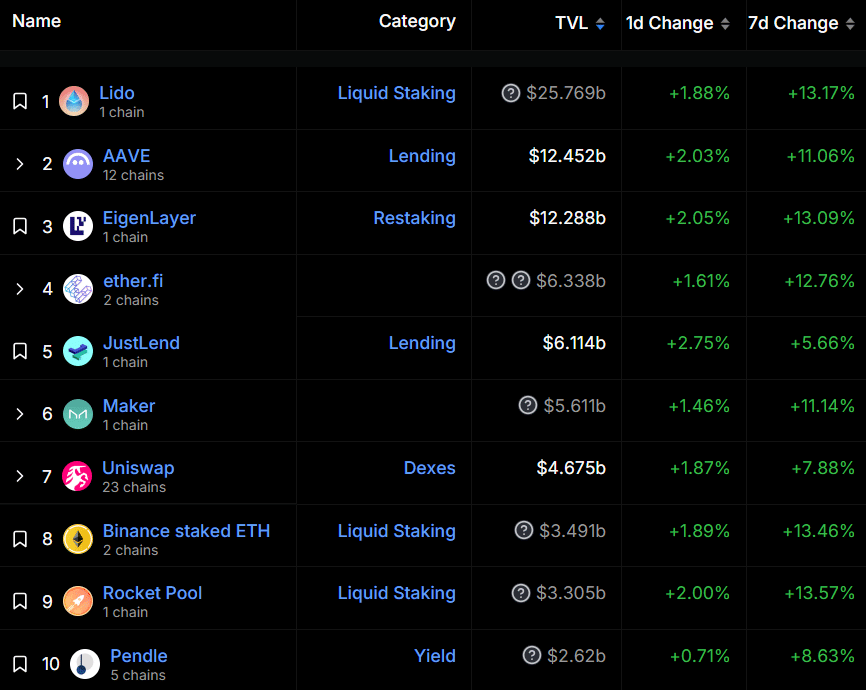

Data shows that the top 10 leading DeFi protocols have all recorded bullish momentum over the past week.

Lido’s TVL surpassed the $25 billion mark after a 13% rise in seven days. AAVE witnessed a quite similar movement and its TVL surged to $12.4 billion. EigenLayer secured the third spot with a TVL of $12.2 billion.

Moreover, Lido DAO (LDO) and Aave (AAVE) — the native tokens of the top two protocols — rose by 1.5% and 7.8% in the past 24 hours, respectively. LDO is currently trading at $1.15 and AAVE surpassed $170.

Ethena lost the 10th spot to Pendle after its TVL decreased by 3% over the past week.

The total value locked in DeFi is still down over 50% from it’s November 2021 high near $188 billion.

The global cryptocurrency market capitalization rose from $2.14 trillion to $2.31 trillion over the past week, according to data from CoinGecko. Most of the gains were recorded on Sept. 18 as the U.S. Federal Reserve cut its interest rates by 50 basis points.