Are we witnessing a major shift in blockchain adoption as Solana’s user numbers skyrocket, or will Ethereum’s continued dominance in high-value applications keep it ahead in the long run?

Solana’s massive comeback

Solana (SOL), one of the most promising blockchain networks in the crypto space, has experienced a wild ride in recent years.

After soaring to new highs in 2021, with SOL hitting a peak of $260.61 in November, the token saw its fortunes reverse dramatically following the collapse of FTX in 2022.

FTX’s founder, Sam Bankman-Fried, was a vocal supporter of Solana, and his trading firm, Alameda, held a large amount of SOL. When FTX went under, it sent shockwaves across the crypto market, and Solana was one of the hardest hit.

SOL’s price plummeted to below $10, losing more than 90% of its value, weighed down by market-wide panic and selling pressure tied to its association with FTX.

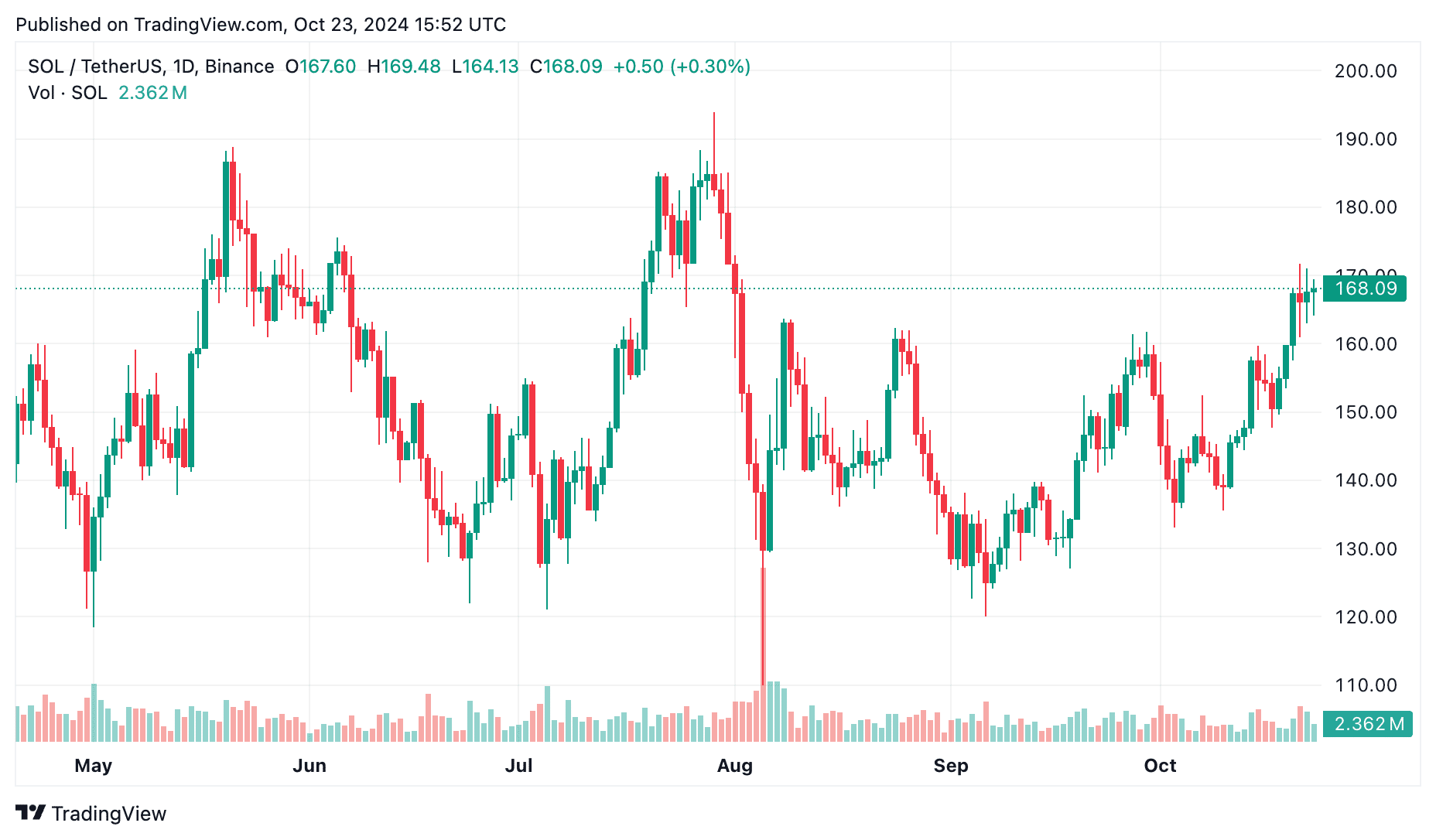

Fast forward to 2024, and Solana’s price action is telling a new story. Starting the year strong, SOL continued its bullish momentum from 2023, gaining ground steadily.

However, by Sep. 6, SOL’s price had cooled off, dropping to a low of $121 as bearish sentiments briefly took over.

Yet, as of Oct. 23, SOL is trading around $168, marking a solid recovery from its September dip and a far cry from the $10 lows seen in 2022.

This resurgence is part of a broader recovery in the crypto market, with bullish sentiment starting to return across major assets.

With renewed interest in Solana’s technology and increasing adoption, is Solana gearing up for another bullish run, or will volatility bring fresh challenges?

Let’s explore the key factors driving SOL’s price, compare them with Ethereum (ETH), and look at expert predictions for where Solana’s price could go in the coming days.

Solana’s 2024 developments: a surge in growth, adoption, and stability

2024 has been nothing short of a breakout year for Solana, marking its best performance in terms of growth, adoption, and stability.

After the setbacks of 2022 and 2023, where its total value locked and other metrics took a nosedive, Solana has managed to stage an impressive recovery, showing strong metrics across various areas of decentralized finance and blockchain performance.

Total value locked — a strong comeback

Total value locked is one of the key metrics used to measure the health and activity of a blockchain’s DeFi ecosystem. It refers to the total amount of assets staked or locked within the platform’s smart contracts.

In simpler terms, it shows how much money is being used within a blockchain’s ecosystem, particularly in DeFi protocols.

For Solana, the story of TVL has been one of drastic highs and lows. In November 2021, during the height of the bull market, Solana’s TVL peaked at over $10 billion, but it quickly shrank in 2022 as the crypto market crashed and the fallout from FTX dealt a heavy blow.

Throughout 2022 and 2023, Solana struggled to regain traction, with TVL numbers steadily declining with no end in sight. However, 2024 has brought a major turnaround.

As of Oct. 23, Solana’s TVL stands at an impressive $6.20 billion, marking a sharp rebound from the mere $1.4 billion seen at the beginning of the year, representing a 342% increase in TVL in less than a year.

To put this into perspective, Ethereum’s TVL has remained relatively stagnant throughout 2024 and has, in fact, been on a downward trend since June, when it hovered around $67 billion. As of Oct. 23, it has declined to approximately $48 billion.

Solana’s explosive rise in TVL, contrasted with Ethereum’s decline, reflects its growing relevance, especially as it attracts more users to its ecosystem.

Solana DEX volume

Another key area where Solana has made key strides is decentralized exchange volume.

DEXs are platforms where users can trade crypto assets without relying on a centralized authority, and the volume of trades on these platforms is an important indicator of how active and engaged a blockchain’s users are.

Solana has not only gained ground in this space but has also managed to outpace its biggest competitor, Ethereum. As of Oct. 23, Solana commands over 30% of the total DEX volume over the last week, a stark contrast to Ethereum’s 16% share.

Just months ago, Ethereum consistently held over 30% of the market, making it the dominant force in decentralized trading. Now, with Solana overtaking Ethereum, we are seeing a shift in user preferences.

Solana’s blockchain can handle thousands of transactions per second, which makes trading on Solana-based DEXs more efficient than on Ethereum, where network congestion and high gas fees can become bottlenecks.

In terms of raw growth, Solana’s share of DEX volume has more than doubled in the last six months, while Ethereum’s share has been gradually shrinking. For Ethereum, this marks one of its lowest points in DEX dominance, showing a clear tilt in market dynamics.

Blockchain performance

When it comes to blockchain performance, Solana is again leading the pack.

According to DappRadar, Solana has processed over 476 million transactions in the last 30 days as of Oct. 23 — a whopping 33% increase in the last 30 days alone.

Meanwhile, the platform’s unique active wallets (UAWs), which represent the number of active users interacting with Solana’s decentralized apps, have also surged. Solana now boasts about 95 million UAWs, a 40% rise in just one month.

In comparison, Ethereum has only processed 7 million transactions in the same period, with its UAW count at 1.66 million, down by 11% over the past 30 days.

However, when we shift focus to total dApp volume, Ethereum remains the dominant player. Ethereum processed over $108 billion in Dapp volume over the past 30 days, whereas Solana lagged behind with only $4 billion.

This comparison shows that while Solana is processing far more transactions and attracting more users, Ethereum still holds the crown when it comes to the sheer value moving through its Dapp ecosystem.

The higher transaction volumes on Ethereum are largely driven by high-value DeFi projects and institutional-grade applications that have long been a part of the Ethereum network.

Decoding the Solana Surge

While several factors are contributing to Solana’s upward momentum, one surprising driver behind its rise is the explosive growth in meme coins.

Coins like Dogecoin (DOGE) and Shiba Inu (SHIB) sparked the meme coin trend, but now, newer tokens are leading the charge. On Solana’s blockchain, the meme coin frenzy has breathed new life into the network’s volumes, fees, and overall activity.

Platforms like Twitter (now X) are flooded with discussions and hype around the latest meme coins, creating a speculative frenzy that often leads to price spikes for these tokens—and, by extension, the networks they run on.

As traders flock to Solana to chase the next big meme coin, the overall network activity skyrockets, bringing more liquidity and attention to the ecosystem.

Ryan Watkins, co-founder of Syncracy Capital and former Messari researcher, recently highlighted Solana’s unique position in the meme coin market.

He pointed to Solana’s role as a “hotbed for all speculative experiments this cycle,” citing the chain’s ability to attract projects.

In Watkins’ words, “I don’t really care whether meme coins are neo-religions or if AI agents are really launching on-chain cults, all I know is all roads lead back to $SOL.”

Adding to the optimism around Solana, another market analyst, Gumshoe, pointed out Solana’s strong performance. “On-chain degeneracy happens on Solana, the market will soon start pricing in the paradigm shift,” Gumshoe mentioned.

Based on expert analysis, there is a growing consensus that Solana is becoming the go-to platform for high-risk, high-reward speculative trading, primarily due to its speed and scalability compared to other chains.

While the meme coin craze has undoubtedly contributed to Solana’s recent surge, it raises the question of sustainability.

Meme coins are, by nature, highly speculative, and their value often hinges on the hype created by social media influencers rather than real-world utility.

This makes meme coins volatile, and their demand could fade just as quickly as it appeared. However, as long as the hype continues, Solana is well-positioned to benefit.

Where could Solana go from here?

Several traders have pointed to specific bullish patterns forming on Solana’s price chart, suggesting that the token could be gearing up for another leg up.

One of the most widely discussed patterns is the Inverse Head and Shoulders formation, a technical setup that often signals a reversal in a downtrend and a potential breakout to higher levels.

MartyParty, a crypto analyst, has highlighted that Solana is currently playing out this pattern, targeting a price of $195 as it breaks out of its current range.

He described the formation as a “Bullish Pennant,” which is generally seen as a continuation pattern that suggests further upward movement.

Similarly, The Moon, a well-known crypto investor and influencer, noted that if Solana successfully breaks out of the Inverse H&S pattern, the potential target could be as high as $202.74.

Meanwhile, according to Crypto Zeinab, Solana must successfully hold above the $171 level for these bullish targets to remain in play. If this level is tested and holds, the upside could open up to $189, followed by $196, as bulls take control of the market.

However, it’s important to remember that while the short-term outlook appears positive, there are still risks involved. As always in crypto, caution is key, and keeping an eye on both technical indicators and broader market trends is essential. Never invest more than you can afford to lose.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.