Discover how tokenization impacts the traditional financial ecosystem by digitizing assets.

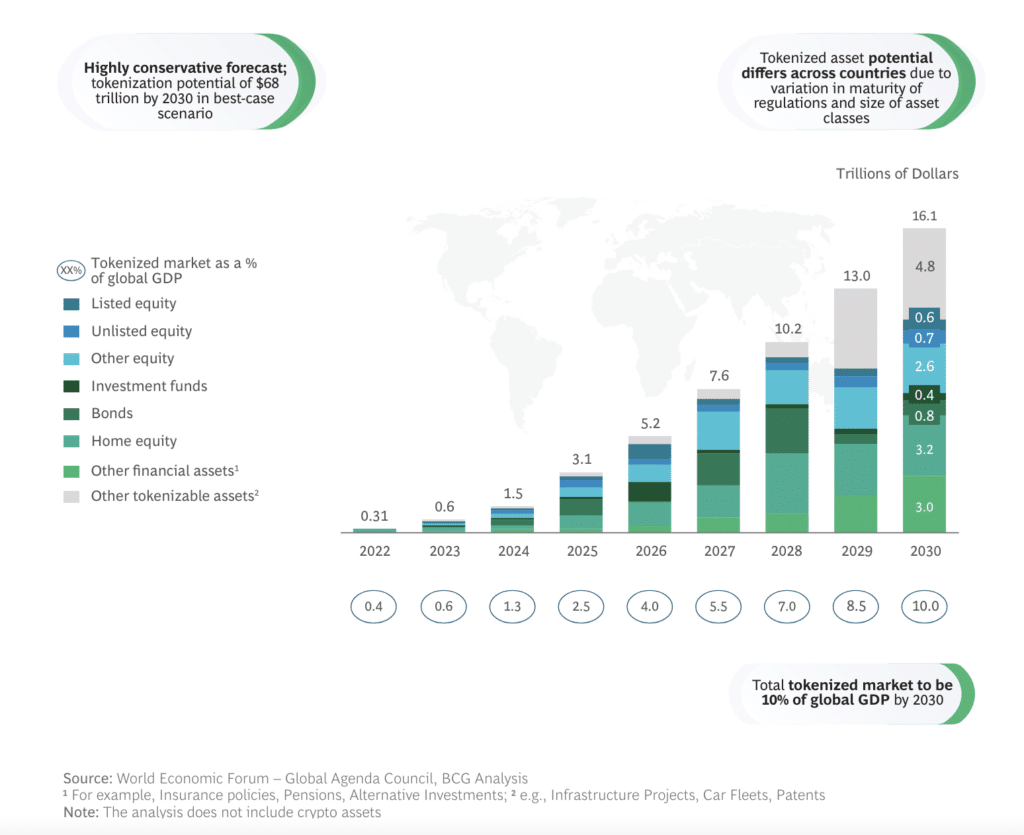

According to a report by digital asset management firm 21.co, tokenization’s market could swell to as much as $10 trillion by the end of the decade, driven by the increasing adoption of blockchain by traditional financial institutions.

Similarly, a report by the Boston Consulting Group projects that the market for tokenized assets could balloon to $16 trillion by 2030.

One of the key drivers behind the growth of tokenization is its potential to transform existing financial infrastructure, increasing efficiencies, reducing costs, and optimizing supply chains.

Yet, the potential of tokenization goes beyond traditional financial instruments. In the future, we could see a wide range of assets tokenized, including bonds, equities, art, automobiles, commodities, and even fine wines.

This expansion into new asset classes has the potential to make investing more accessible and bring new liquidity into markets that have traditionally been complex and slow-moving.

So, let’s find out what tokenization is and why it matters.

Tokenization explained: what is tokenization in crypto?

Tokenization in crypto refers to converting real-world assets, such as stocks, bonds, real estate, or even physical goods, into digital tokens on a blockchain.

These tokens represent ownership or a stake in the underlying asset and can be traded or transferred easily and securely.

What is the purpose of tokenization? Typically, tokenization aims to introduce liquidity to traditionally illiquid markets. Assets that were once difficult to buy or sell can be traded instantly on blockchain-based platforms through tokenization, reducing transaction costs and increasing market efficiency.

How does tokenization work?

Here’s a step-by-step overview of how tokenization typically works:

- Asset selection: An issuer selects an asset to be tokenized. This could be anything from real estate to stocks, bonds, or commodities.

- Tokenization process: The asset is divided into digital tokens, each representing a fraction of the underlying asset. This process is often facilitated by smart contracts, which are self-executing contracts with the terms of the agreement directly written into code.

- Issuance: The tokens are issued on a blockchain, where they can be bought, sold, or traded. Each token is unique and contains metadata that describes the asset it represents.

- Trading and ownership: Once the tokens are issued, they can be traded on blockchain-based platforms. Ownership of the tokens is recorded on the blockchain, providing a transparent and immutable record of ownership.

- Redemption: Token holders may have the option to redeem their tokens for the underlying asset. This process is typically governed by the terms set out in the smart contract.

- Regulatory compliance: Throughout the process, issuers typically ensure compliance with relevant regulations, such as Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements.

Benefits of tokenization

By converting real-world assets into digital tokens on a blockchain, tokenization provides the following benefits:

- Increase accessibility: Tokenization allows for fractional ownership, enabling smaller investors to access assets that were once out of reach due to high costs or barriers to entry.

- Enhance liquidity: Tokenization makes traditionally illiquid assets, such as real estate or fine art, more liquid by enabling them to be traded on blockchain-based platforms, thereby reducing transaction times and costs.

- Improve efficiency: By removing intermediaries and streamlining processes, tokenization can increase the efficiency of asset transfer and management, reducing costs and administrative burdens.

- Enable borderless transactions: Blockchain-based tokens can be traded globally, enabling seamless cross-border transactions without the need for intermediaries or complex regulatory processes.

- Enhance security: Blockchain provides a secure and transparent ledger for tracking ownership and transactions, reducing the risk of fraud and ensuring the integrity of asset ownership.

How to invest in tokenization

Investing in tokenization offers a range of opportunities for those looking to diversify their portfolios. Here are several practical ways how to invest in tokenization technology

- Buy tokenized stocks: Purchase tokenized stocks of well-known companies like Google or Meta on crypto exchanges. These digital assets represent traditional stocks and offer benefits like 24/7 trading and fractional ownership.

- Invest in tokenization ventures: Consider buying crypto tokens issued by projects focused on tokenization. Research the project’s team, token liquidity, and progress before investing. Look for projects with a strong use case and potential for growth.

- Acquire layer-1 tokens: Look into purchasing layer-1 (L1) blockchain tokens of platforms that enable tokenization, such as Ethereum (ETH), Solana (SOL), Avalanche (AVAX), and BNB Chain (BNB). These tokens are the foundation of their respective blockchain networks and may see increased demand as tokenization grows.

- Invest in exchange-traded products (ETPs): Some platforms offer ETPs that provide exposure to tokenized assets. These products can provide a convenient way to invest in tokenization technology.

Tokenization platforms

These platforms provide the infrastructure and tools necessary to tokenize real-world assets and facilitate their trading and management on blockchain networks. Here are some notable tokenization platforms:

- Backed: Backed is building on-chain infrastructure for capital markets, offering tokenized securities that represent real-world assets like bonds, stocks, and ETFs.

- Maple: Maple is an on-chain marketplace focused on providing high-quality lending opportunities to institutional and accredited investors, catering to their liquidity, risk, and return requirements.

- Matrixdock: Matrixdock is a digital assets platform that gives institutional and accredited investors transparent access to tokenized RWAs, ensuring an immutable record of ownership and daily proof-of-reserve.

- Ondo: Ondo offers on-chain financial products such as tokenized notes backed by short-term US Treasuries and bank demand deposits.

- Polymath Network: Polymath is a platform for creating tokenized securities, offering a streamlined process for issuers to digitize securities on the blockchain.

- Securitize: Securitize is a compliance platform for digitizing securities on the blockchain, ensuring that tokenized securities comply with regulatory requirements.

Risks and challenges of tokenization

Investing in tokenization offers exciting opportunities, but it also comes with risks and challenges that you should be aware of:

- Regulatory risks: Tokenization is a relatively new concept, and regulations surrounding it are still evolving. Changes in regulations could impact the value and legality of tokenized assets.

- Market volatility: The crypto market is known for its volatility, with token prices often experiencing wild fluctuations. You should be prepared for the possibility of sudden price changes.

- Security risks: Digital assets are susceptible to hacking and other security breaches. You should take precautions to protect your assets, such as using secure wallets and exchanges.

- Lack of liquidity: Some tokenized assets may have limited liquidity, making it challenging to buy or sell them at desired prices.

- Technology risks: Blockchain is still evolving, and there are risks associated with bugs, glitches, and other technical issues that could impact tokenized assets.

Going by the hype, the tokenization market could continue growing, with more assets being tokenized and greater adoption of blockchain.

However, you should proceed with caution and carefully consider the risks involved before investing in tokenization.