Solana price has remained in a deep bear market, falling by over 30% from its highest point in 2024.

Solana (SOL), the fifth-largest cryptocurrency in the industry, was trading at $145, down from its year-to-date high of $210. Its valuation has retreated from a YTD high of $86 billion to $68 billion.

SOL is in a bear market because of its correlation with Bitcoin (BTC) and other altcoins. Bitcoin has dropped by almost 20% from the YTD high while coins like Ethereum (ETH), Avalanche (AVAX), and Cardano (ADA) are down by over 30%.

Altcoins like Solana typically make bigger moves than Bitcoin. They perform better when Bitcoin is rising and significantly underperform when it is in a downtrend. For example, BTC rose by 70% between Jan. 1 and March 24, while SOL and ETH rose by over 80% during the same period.

Solana has also retreated as it faces substantial competition from Tron (TRX), which recently launched SunPump, a meme coin generator. The DEX volume on Solana in the past seven days has fallen by almost 9% while Tron’s has risen by over 210% to $1.70 billion.

Most of Solana’s meme coins have also retreated. Dogwifhat has dropped by almost 70% from its highest level this year, while Book of Meme (BOME) has fallen by 80% from its all-time high.

Tron has also overtaken Solana in DeFi total value locked, the number of active addresses, and stablecoins. Tron has over $8.3 billion in assets, 2.47 million in addresses, and almost $60 billion in stablecoins. In comparison, Solana has $5.16 billion, 1.74 million, and $3.9 billion, respectively.

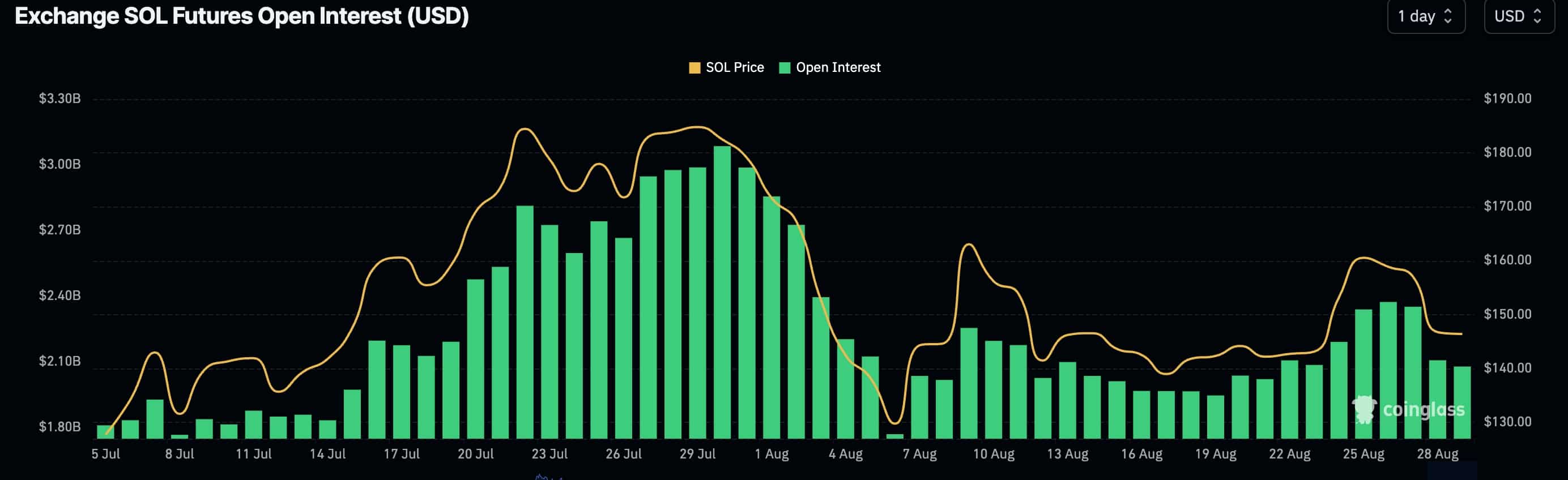

Solana’s futures open interest has fallen

Meanwhile, Solana’s open interest in the futures market has been in a downtrend. Most recently, the interest peaked at $3 billion in July and has pulled back to $2 billion, signaling waning demand.

Solana has also dropped because of the ongoing performance of spot Ethereum ETFs. The latest data shows that they have not become popular. They have had cumulative outflows of $481 million and have shed assets in five of the last six weeks.

Therefore, if the trend continues, there is a likelihood that companies like Blackrock, Fidelity, and Franklin Templeton will not apply for a spot Solana ETF. The SEC has also been reluctant to approve these funds. Earlier this month, the agency turned down Cboe Global Markets’ 19b-4 filing for a Solana fund.

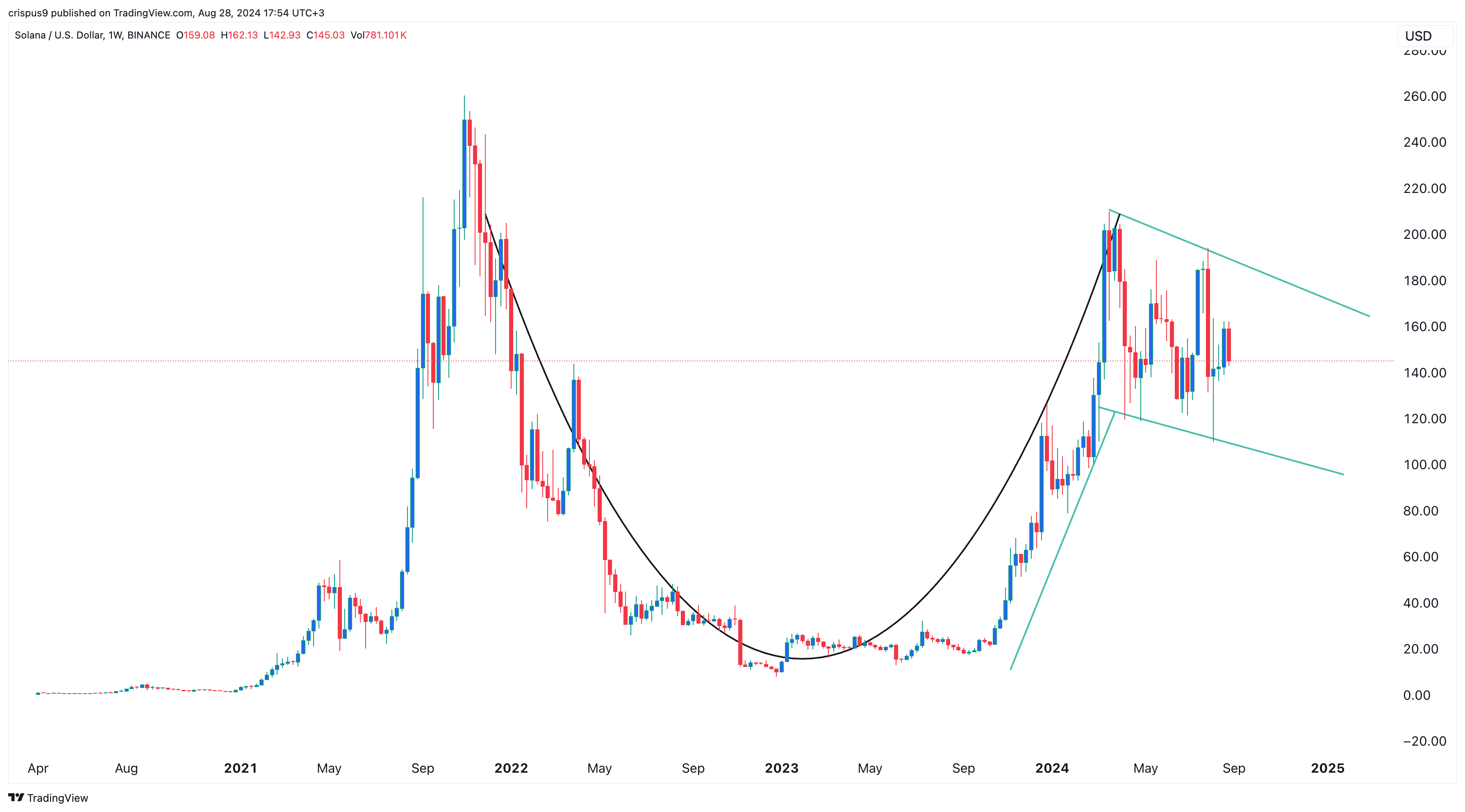

Technically, as shown above, the pullback is likely part of the formation of a bullish flag pattern. It is also part of the hand section of the cup and handle pattern on the weekly chart. If these patterns work out well, Solana will likely bounce back later this year.